Day 10: Avoid Being Stupid

365 Days of Learning Investing: I tried, Tesla is a pass for me and Weekly cool-headed review of the markets and macro with charts.

Note: I posted my first 14 Days of the 365 Days of Investing series when I had less than 300 readers. Since my newsletter is education first, I thought it might be useful for you to read my early posts.

Key Takeaways Today:

How to avoid making stupid mistakes in investing.

Tesla is a pass for me.

Weekly cool-headed review of the markets and macro with charts.

Recap of Day 9:

Financial Statements are not that hard to learn. Just needs more practice, like any new skill.

Alphabet is #1 in digital ads, #1 in search, #1 in video platform, #3 in cloud and a buy.

Since I asked, Bill Ackmann is breaking down financial statements for you.

Micro Learning - Avoid Being Stupid

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent." - Charlie Munger

How do I avoid being stupid?

Investing in familiar companies: this saves lots of time in understanding their products/services. For instance, I went through Adobe’s Digital Media (Photoshop etc) segment in a breeze, while it took me some time to understand the Digital Experience (marketing etc) segment. Reading the latest 10-K, 10-Q, transcripts is a must regardless. Search SEC Edgar or google “Ticker IR”. Example: ADBE ir

Highly covered companies: I invest in highly covered companies, usually covered by 30+ analysts. This almost eliminates the need for financial modeling, as you can use the consensus model. Also, I don’t have access to the unit, industry level data and contacts that they probably have. I doubt my model would be better than a group of analysts that eat and breathe the company for a living. My job is to understand the why and how behind the modeling. Use Koyfin.

Earnings surprises data: usually 80 quarters (20 years) if available. Companies I invest almost never miss the consensus, especially annually. I think this shows the predictability or “modelability” more than the analyst skill. Use Koyfin.

Keep valuation simple: historical multiples with context and reverse DCF, it just has to be reasonable. Use Koyfin for free, google reverse DCF template. FASTgraphs is paid.

Position sizing: I usually start with a small position, 2-3% of my portfolio. Conviction usually comes with time as I dig deeper and/or once I read up more from other people for more insights.

Have some balls: Also, I’m good at “f*ck it money” once I’m invested. I don’t panic sell unless it becomes clearly obvious that I made a mistake.

How do you avoid being stupid? Comment below, let’s discuss.

2. Company Profile - Tesla (TSLA)

Important: There might be some terms which are new to you, no worries, keep reading anyway. I will explain them in time, or you will just figure them out before I do, as they will keep repeating on every post.

1. History

Founded: 2003 by Martin Eberhard and Marc Tarpenning. Elon Musk joined in 2004, leading the initial funding round.

Key Milestones:

2008: Launch of Tesla Roadster, Tesla's first EV.

2012: Launch of Model S sedan.

2021: Model 3 surpasses 1 million global sales, becoming the first EV to do so.

2023: Model Y becomes the best-selling vehicle globally.

Headquarters: Austin, Texas, USA.

2. Products and Services

Electric Vehicles (EVs):

Models: Roadster, Model S, Model 3, Model X, Model Y, Cybertruck (2023 launch), and Tesla Semi (2022).

Vehicle Deliveries (2023): 1.37 million units globally, a 47% YoY growth.

Energy Solutions:

Powerwall, Megapack, Solar Panels, and Solar Roof.

Energy Revenue (2023): $3.5 billion (10% of total revenue).

Supercharger Network:

50,000+ Superchargers in over 5,000 locations worldwide.

3. Business Segments

Automotive: 81% of revenue ($82 billion in 2023).

Energy Generation & Storage: 19% of revenue ($14 billion in 2023).

Tesla is internationally diversified but still highly dependent on China:

4. TAM (Total Addressable Market) and SAM (Serviceable Addressable Market)

EV Market TAM: Estimated $1 trillion by 2030.

Renewable Energy Market TAM: Projected at $1.9 trillion by 2030.

Tesla's SAM:

EV penetration expected to grow from 15% in 2023 to 50% by 2035 globally.

Increasing adoption of renewable energy and grid storage solutions.

5. Competitors

EV Manufacturers:

BYD: Delivered 1.9 million EVs in 2023.

Volkswagen Group: Delivered 572,000 EVs in 2023.

Ford: 61,575 EV deliveries in 2023.

Autonomous Technology:

Waymo, Cruise, and other tech-focused companies.

Renewable Energy:

Enphase Energy, SunPower, and traditional utilities.

6. Market Share

Global EV Market Share: Tesla holds 19% (2023).

U.S. EV Market Share: Tesla accounts for 61% of EV sales (2023).

7. Moat

Brand Leadership: Iconic reputation in EVs and energy innovation.

Supercharger Network: Largest global fast-charging network with 50,000+ chargers.

Battery Technology: Leading in battery density, range, and cost reduction.

Software Edge: Advanced self-driving (FSD) and over-the-air updates.

8. Management and Ownership

CEO: Elon Musk, CEO since 2008.

Elon Musk's Ownership:

Percentage: 13% of shares.

Value: ~$182 billion (at $418/share, market cap $1.4 trillion).

Insider Ownership: ~20% of total shares.

9. Valuation

Tesla has become more predictable recently, especially if we look at the data annually. This is usually a good sign.

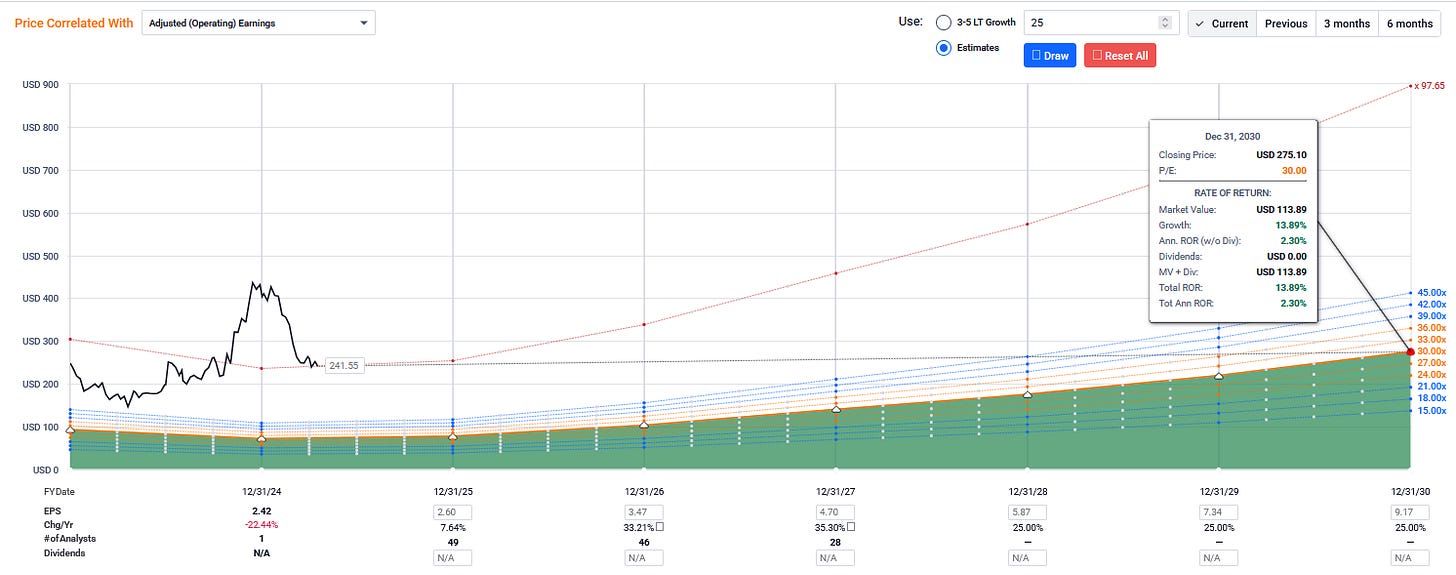

Analysts are projecting about 20% revenue and 25% EPS growth in the next 5 years. I would take any projections beyond 5 years with a grain of salt because the number of analysts making estimates drops from 45 to 3 for year 7.

I couldn’t get to any meaningful valuation with 20-25% growth and 30 P/E multiple, which I believe is ridiculous because that is very generous. In this case, total return would be around 14% total or 2.3% annual in the next 5 years. Not enough margin of safety for me. Pass. Too hard. Tesla might achieve all its promises in the future, but I can’t invest based on that.

3. Useful stuff

Cool-headed review of the markets and macro with charts, taking the long view. Charlie posts weekly videos. Probably the only source you need.

What Paid Subscribers Unlock

Everything in free, plus the research and access that saves time and gives you an edge.

Real-time list of undervalued S&P 500 stocks — updated daily. Tools for NASDAQ, Russell, and international stocks are coming soon

Buy and sell alerts with full position sizing — follow what I’m doing, when I’m doing it, and why

Full access to my personal and client portfolios — including wins, losses, and allocations

Subscriber-only chat — ask questions and connect directly with me and the community

50% Off Forever

You can lock in lifetime access right now at half price.

$15/month or $120/year

Regular price is $30/month or $240/year.

This offer is only for the first 100 subscribers. This newsletter is moving up the ranks because the seat are filling up quickly. Claim your launch discount here before it ends.

Affiliate links for discount:

Koyfin - 10%

FASTGraphs - 25%

Share this newsletter with your family, friends, colleagues and strangers. We might end up changing their lives!

If you want to keep being part of this journey, subscribe.

Your comments are super motivating.